Customs, Duties, and GST

Customs

Electronic Export Information (EEI) filing is generally required by the U.S. Customs and Border Protection for U.S. exports that contain a single commodity's value exceeding $2,500 USD.

There are some complicated regulations for expensive packages. We strongly recommend that you split your package into several parts to keep the total value under $ 2,500. If repacking is not possible, we must prepare an EEI (Electronic Export Information) form for you. There is a $40 fee for this service and packages requiring an EEI form must be shipped via specific carriers available during mailout.

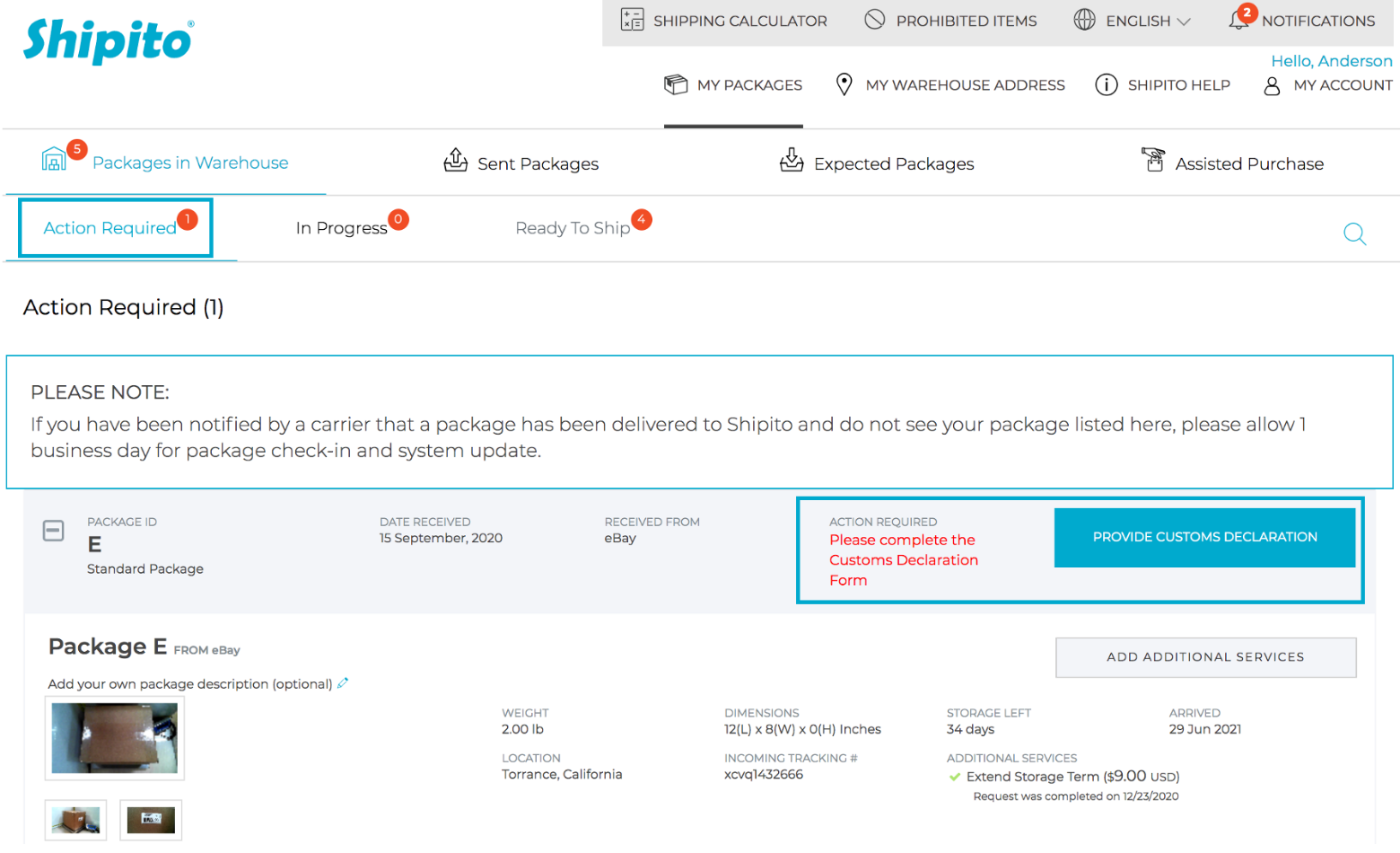

In case you do not fill out your Customs Declaration Form, we are unable to ship your packages to you. To learn more, please watch this video.

Follow these steps below to fill out your Customs Declaration Form.

- Log in to your account

- Click "Packages in Warehouse"

- Click "Provide Customs Declaration"

- Fill out Customs Declaration Form

The following countries do not allow used items to be imported:

- Brazil

- South Africa

- Uganda

- Vietnam

- Indonesia

IMPORTANT NOTE:

- You will not avoid possible duties and taxes by selecting GIFT.

- You must indicate if the package contains batteries or dangerous goods.

- If you do not declare the correct amount, you have to fix the declaration amount in order to ship your package.

- Any reimbursements are based on the declared value and it is your responsibility to ensure that your packages are declared completely and accurately as soon as the package arrives. Please also understand that we cannot offer any compensation for delays caused by lost packages. The reimbursement is based on whatever is less, the declared or invoice value.

Yes, you are responsible for paying all customs clearance, duties or taxes. These can be paid in one of two ways:

- Pay directly: Contact the package courier directly to pay.

- Pay COD: If you would like to pay upon delivery, contact Shipito 2-3 days before your package arrives and provide us with the courier's name, amount due and the tracking number. Lastly, please deposit sufficient funds into your account to complete the COD payment.

If you have not paid duties and taxes in advance or you don't have enough funds in your account to cover charges, packages are subject to refusal and may be returned to sender.

Australia GST

Australian consumers are now required to pay the 10% GST tax on “low-value” items purchased from international retailers and valued at $1,000 AUD or less. Shipito collects the GST tax on these purchases and remits directly to the Australian government on your behalf. The GST tax is calculated based on the value of the items you are shipping, plus any Shipito service fees and shipping charges.

- Shipito will NOT collect GST and you are required to remit payment directly to the Australian Taxation Office.

For any purchased valued at $1,000 AUD or less

- If you have an ABN (Australian Business Number) on file with Shipito, you will not have to pay the taxes at mail out but can submit the fees to the Australian Government with your regular quarterly tax payment.

- If you DON'T have an ABN (Australian Business Number) on file with Shipito, postage and processing fees will be assessed a 10% GST at the time of shipping.

+

1/11 Fee (for services) + 1/11 Fee (for insurance) + 1/11 Fee (of the shipping cost)

Important Note: Due to the separation of content value and shipping, you will see 2 separate GST fees when you mail out your package

- Login to your account

- Go to "My Account"

- Select "Modify Address Book"

- Enter ABN in the Tax ID space. You must have the ABN listed for each address you ship to.

China:Duties, Taxes, and Import Limits

The import limit for a personal shipment with more than one item in the package is 1,000CNY. Items valued at greater than 1,000CNY with multiple items in the box must clear as commercial import. Items with a value greater than 1,000CYN and declared as personal use will be returned to the US if the package contains more than one item. If the shipment has only one item, there is no value limit, however Chinese customs reserves the right to approve the importation of a package or deny and return to the US regardless of whether it has 1 item or many in the box.

If you are importing items valued at 20,000 CYN or more per year, then all shipments must be cleared as a commercial import.

New Zealand GST

New Zealand consumers are now required to pay the 15% GST tax on “low-value” items purchased from international retailers and valued at $1,000 NZD or less. Shipito collects the GST tax on these purchases and remits directly to the New Zealand government on your behalf. The GST tax is calculated based on the value of the items you are shipping, plus any Shipito service fees and shipping charges.

For any purchased valued at $1,000 NZD or less

+

This will also apply to services, insurance and the shipping cost.

Important Note: Due to the separation of content value and shipping, you will see 2 separate GST fees when you mail out your package

- Login to your account

- Go to "My Account"

- Select "Modify Address Book"

- Enter New Zealand IRD in the Tax ID space. You must have the New Zealand IRD listed for each address you ship to.